Deploying sound corporate governance structures can make a big difference in the lives of entrepreneurial families. Scott McCulloch looks at the key business instruments.

Good corporate governance is one of those terms we often hear about, but how many families understand its full meaning?

And how many put good corporate governance fully into practice?

It’s not uncommon for employees, even senior executives, to confuse governance with management yet both practices are quite different.

Management involves the day-to-day running of the business, while good corporate governance sets out the parameters within which that activity takes place.

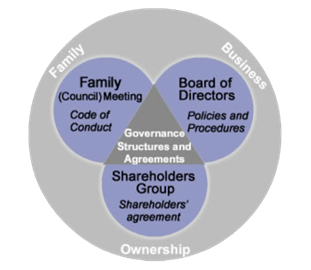

Think of the classic three-circle family business model – the intersection of family, business and ownership – and you have a practical starting point for developing good corporate governance.

Three Circle Governance

Within each sphere of activity, or circle, corporate governance has three components: practices, governance structures for those practices, and the desired outcomes of those practices.

For example, a family may want to develop its communication channels (a practice) through the set up of a family council (a governance structure) with the outcome being, say, a family code of conduct.

-----

Listen to the Taylors, a 3rd generation winemaking business family, describe how their inclusive family governance mechanisms, such as family meetings and forums, enable them to communicate effectively and avoid major conflict.

-----

In the business circle, a practice might be understanding risk, which could lead to the set up of a board of directors whose outcome is to develop a strategic plan.

In the ownership circle, setting ownership criteria for family could lead to shareholder meetings (a structure) whose outcome could be an ownership succession plan.

Learning how to manage family early pays dividends down the road

KPMG Canada says the needs of a family business must be balanced against the demands and expectations for the family business in order for it to grow and prosper.

“Learning how to manage the family component early on in the evolution of a family business, through the use of family councils, family constitutions, boards and the like will pay dividends down the road,” the management consultants point out in a governance report.

Strong Family Governance

Joliette, Quebec-based Techno Diesel Inc. is a great example of a young family enterprise that implemented a good corporate governance structure to help it grow and smoothly transition from first to second generation.

Founded in 1977, the heavy truck repair firm transitioned from parental ownership to four daughters. Each following their own path, the daughters joined the family business one by one starting in 2001.

As the four next-gens took on more responsibilities, they eventually took over the business. Their mother had sought external help to ensure a smooth transition.

They were able to set up a four-level structure that helped them separate family issues from governance and management.

They formed an executive committee of company managers and an advisory committee comprising external entrepreneurs to advise on strategic vision.

They set up a CEO-led shareholder board and a family council to discuss family relations.

“When we talk about governance structure, it’s also about enabling shared decision making,” explains Techno Diesel CEO Caroline Thuot in a Business Development Bank of Canada case study.

“We’re five young people under 40 who co-own a business. And we do it together.”

That doesn’t make it easy. Family businesses can face particular challenges when it comes to governance, say experts familiar with family ownership dynamics.

Define Your Success

Among these is the need for clarity in relation to what family members want from the business. The board, especially non-family, must be clear about what success means for the family.

It could mean the overall return on investment that the family wants. It might be a combination of economic returns and other, non-financial, returns on investment to which the family attribute value.

Regardless, family shareholders need to clarify what they mean by success and the board then has to help the company achieve it.

That’s why family enterprises are unique and different from other types of businesses that tend to focus only on economic returns.

As for the Thuot sisters, mastering good corporate governance just might be in their DNA.

According to a study published in the International Journal of Business Governance and Ethics, Canadian women who sit on corporate boards are more likely to “rock the boat” and be more open to new ideas than male board members.

Whatever the case may be, being open to good corporate governance can translate into better decisions and financial success.

Can your family distinguish between sound management and good corporate governance?

-----

Learn more about why families need better governance.

-----